- Products

- RegLab for ...

- Knowledge centre

Download the AML glossary >

Discover the essential AML compliance terminology and gain instant access to a comprehensive guide

Discover the essential AML compliance terminology and gain instant access to a comprehensive guide - The company

Working at RegLab >

Join RegLab as the new Product Owner of our software tool and change the way the legal community approaches anti-money laundering.

There may not be any vacancies that perfectly match your profile, but that does not mean there is no room for someone who can improve RegLab.

- Book a demo

Sanctions Act:

full compliance with the sanction check

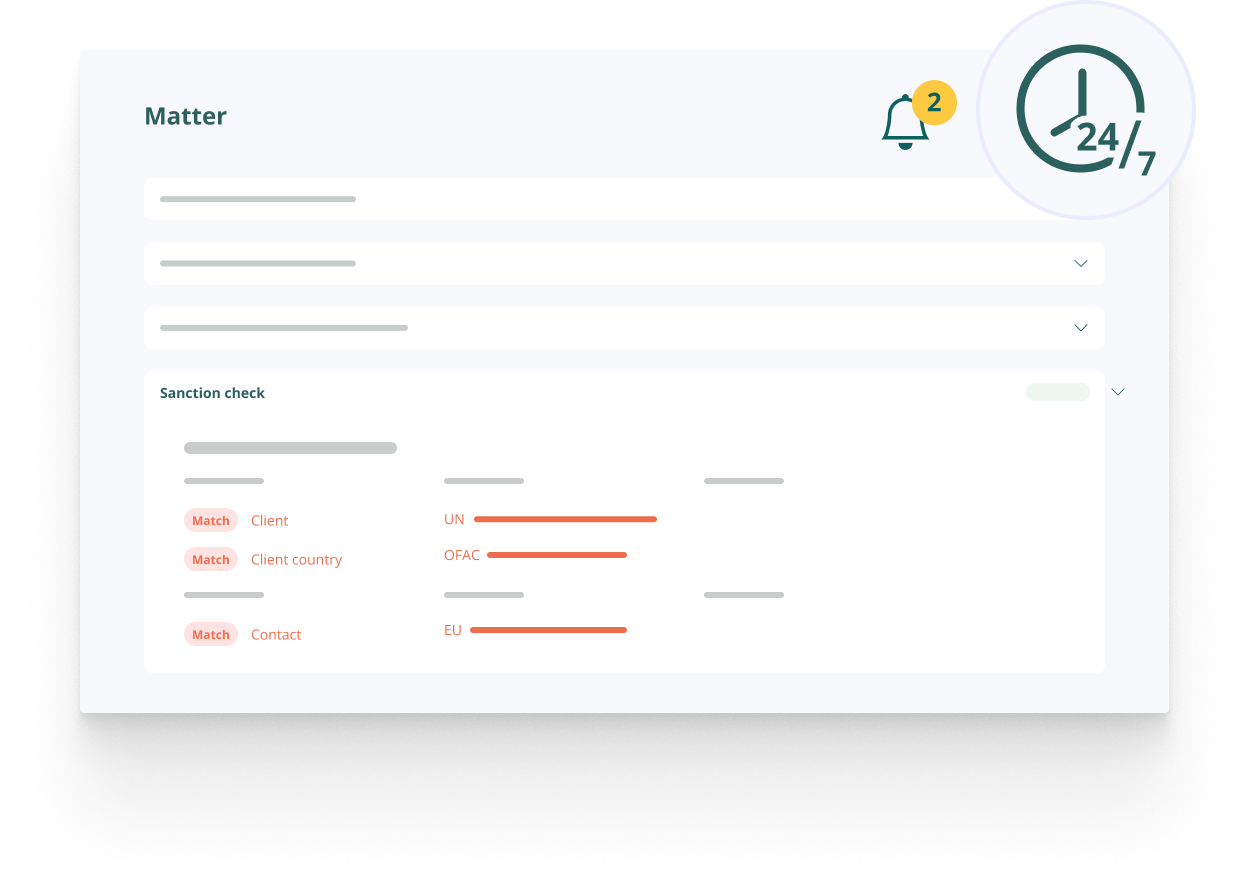

Always comply with the Sanctions Act? RegLab makes it easy. With the RegLab screening tool, you can effortlessly check all national and international sanctions lists and lists of high-risk countries. In this article, you can read what the Sanctions Act entails, which lists exist, and how to easily perform a sanctions check and continuous monitoring — fully automated.

Screening tool

The Sanctions Act requires you to periodically check your clients. A one-time check during onboarding is not enough. You must continuously monitor your entire client base for possible sanctions. But how do you do this quickly and effortlessly, without using your own resources?

You want to automatically screen your client base without wasting time and energy. Manual monitoring is challenging. Various sanctions lists, such as the EU sanctions list, are continuously updated. RegLab helps you with this.

RegLab automatically cross-checks your entire client base against the latest sanctions lists and high-risk country lists. Not only the client, but also the contact person, UBOs, representatives, and their countries of residence are screened. If a person or country appears on any of these lists, you will immediately receive a notification.

Especially in the legal sector, we see that Bar Associations are becoming more active in encouraging firms to carry out these checks. Many firms therefore subscribe to the lists and check client files manually. This is time-consuming. Outsource the screening to RegLab instead.

What sanctions lists are there?

Sanctions measures apply not only to individuals, but also to countries and organisations. All sanction regulations can be found on the websites of the European Union, United Nations, and the Dutch government. Sanctions measures may include:

- Freezing of assets

- A prohibition on making funds available

- A prohibition or restriction on providing financial services

To find out whether someone you do business with is on a list, you use sanctions lists, including those from the US, UN, Netherlands, and the EU sanctions list. These sanctions lists, which you can subscribe to, are regularly updated. It is crucial to consult up-to-date sanctions lists and continuously monitor your current client base. The Dutch list is still manageable, but the EU sanctions list is frequently updated. Europe is very active in this regard, resulting in regular changes for organisations and individuals. This makes it challenging in practice.

High-risk country lists

There are also high-risk country lists, which include countries that do not have their AMLD processes in order, such as North Korea and Iran.

A client appears on a sanctions list, now what?

You must take immediate action if a client, or an associated party, appears on a sanctions list. The specific action required depends on the sanctions regime. The nature of the services provided also plays a role. You must immediately cease providing services to the client and inform them. Without an exemption, providing services is prohibited. You can apply for an exemption at the Ministry of Foreign Affairs and Development Cooperation.

For other questions about sanctions legislation, you can contact the Ministry of Finance: sancties@minfin.nl

What if you do not comply with the AMLD and the Sanctions Act?

Suppose your firm does not comply with the guidelines of the AMLD and the Sanctions Act. What are the consequences?

- Supervisors can impose a fine, sanction, or penalty payment if a firm does not comply with the AMLD and Sanctions Act. They can also prosecute for failing to report. In addition, criminal prosecution is possible for facilitating money laundering.

- Failing to report an unusual transaction, while knowing it is unusual, can result in fines. Violating the Sanctions Act is an economic offense under Article 1, subsection 2 of the Economic Offenses Act.

For many firms, the AMLD and the Sanctions Act still feel distant. However, we see that the number of inspections and fines for non-compliance is increasing.

Sanctions Act: Full compliance with the RegLab screening tool

With RegLab, you can easily comply with the guidelines of the Sanctions Act. Screening and monitoring are fully automated. You automatically receive a notification of an increased risk. This also applies if other parties are added or UBOs change. All sanctions lists and high-risk country lists are included. Up-to-date and complete.

RegLab for complying with the Sanctions Act

- Fully automated screening

- Based on all current lists

- Screening and monitoring

- Checks of all associated parties

- Automatic notifications

Want to know more? Book a demo

The importance of the Sanctions Act

The Sanctions Act was created to combat money laundering and stop terrorist financing. In this article we clarify its importance.