- Products

- RegLab for ...

- Knowledge centre

Download the AML glossary >

Discover the essential AML compliance terminology and gain instant access to a comprehensive guide

Discover the essential AML compliance terminology and gain instant access to a comprehensive guide - The company

Working at RegLab >

Join RegLab as the new Product Owner of our software tool and change the way the legal community approaches anti-money laundering.

There may not be any vacancies that perfectly match your profile, but that does not mean there is no room for someone who can improve RegLab.

- Book a demo

RegLab for tax advisors

Benefit from complying with AML regulations

As a tax advisor, you are required under the AMLD to maintain transparency in your relationships with clients. The legislation expects fiscal openness and obliges you to detect, investigate, and record unusual transactions. This can be challenging, not only due to your demanding schedule, but also because you wish to preserve the trust you have built with your clients.

RegLab can help with this. RegLab’s compliance software streamlines and standardises the client onboarding process. This makes the due diligence process faster and more straightforward for both you and your clients. It also allows you to focus more on your core responsibilities, all while remaining fully compliant with your AML obligations.

Need extra support? Our compliance specialists are ready to help. Whether it’s drafting risk profiles, assisting with audits, or reviewing matters, you’re not alone. And if you need to get started quickly, e.g., due to an upcoming inspection, you’ll be up and running within a week.

Learn more on this page about how our software helps your firm meet AML obligations with ease or book a demo.

AML module

This module is more than a simple 'check the box'. It is a well-thought-out workflow, ensuring that you are 100% AML compliant.

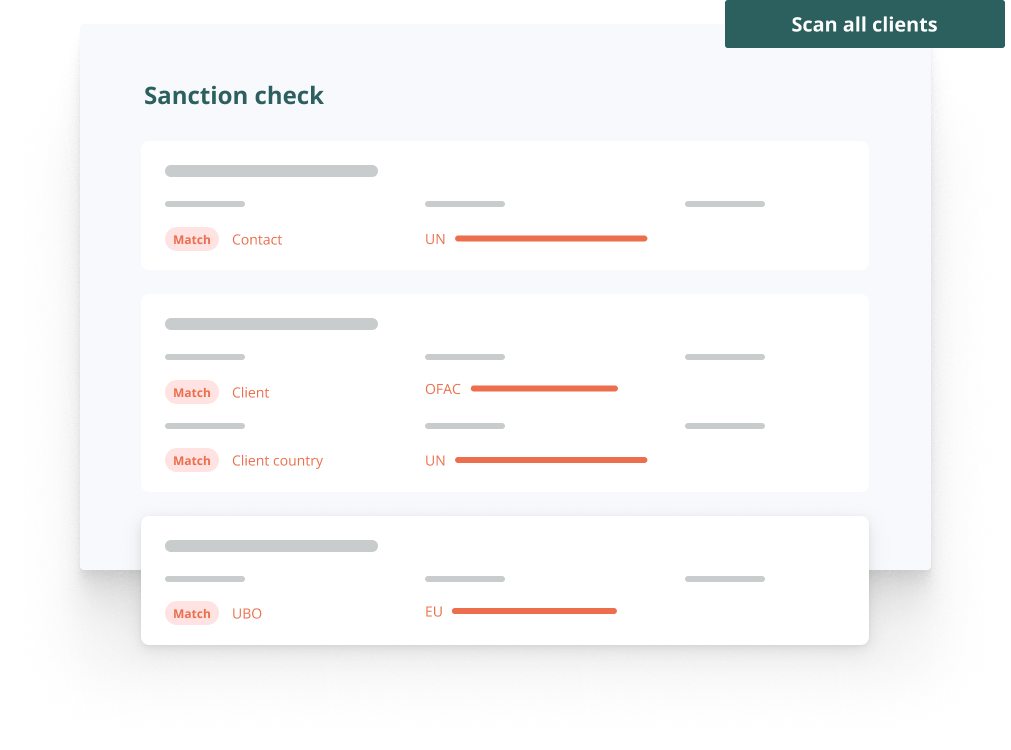

Comprehensive screening

RegLab checks and informs you about all PEPs, adverse media, watchlists and sanction and high-risk country lists.

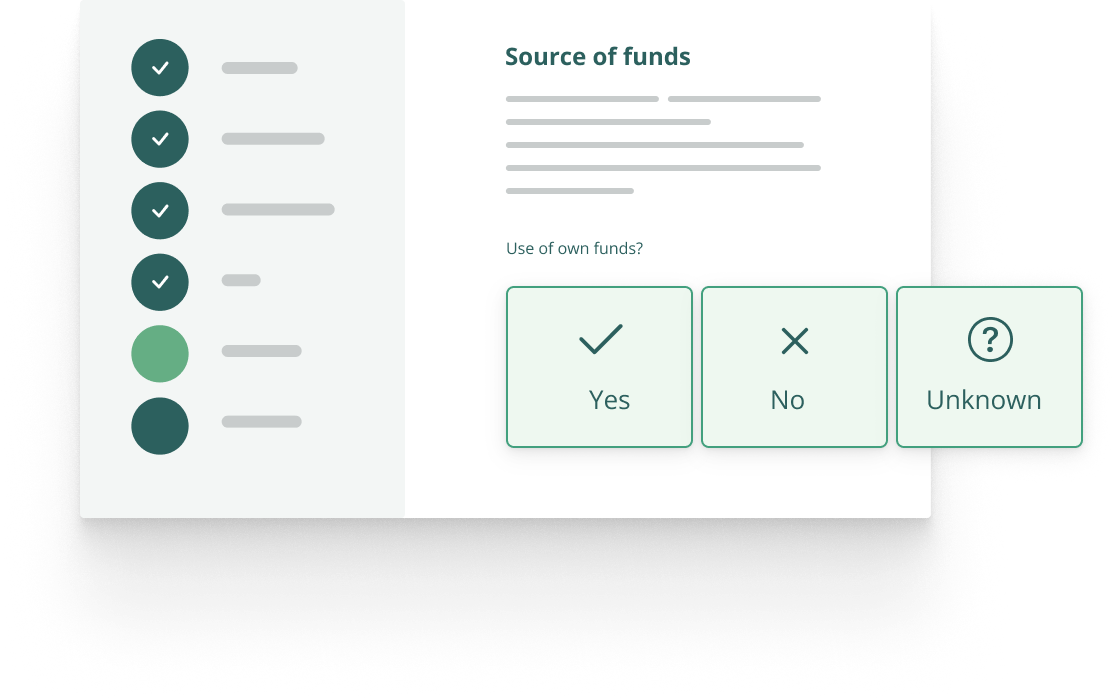

Origin of funds

For financial transactions that are subject to the AML, you must investigate the origin of funds. RegLab takes this work off your hands, 100% accurately and fully automated.

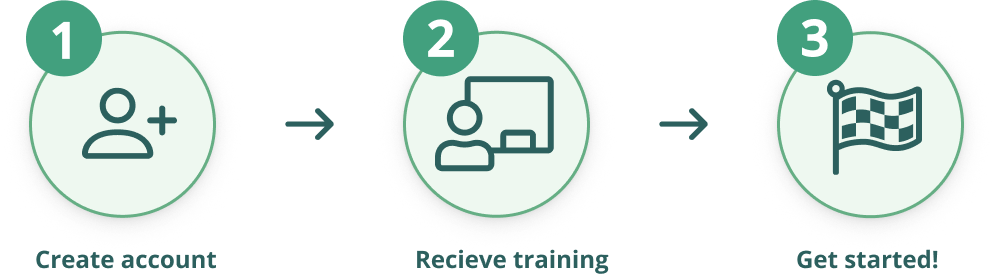

Getting started within a week

Do you want to get started with RegLab in the short term? For instance, because the supervisor will be conducting an audit soon? You will be up and running within a week.

These firms preceded you:

Testimonials —

Svalner Atlas Advisors (formerly Atlas Tax Lawyers)

“RegLab has helped us to streamline our procedures”

— Read more

Testimonials —

VanLoman

"RegLab makes our AML process faster, clearer and easier."

— Read more