- Products

- RegLab for ...

- Knowledge centre

Download the AML glossary >

Discover the essential AML compliance terminology and gain instant access to a comprehensive guide

Discover the essential AML compliance terminology and gain instant access to a comprehensive guide - The company

Working at RegLab >

There may not be any vacancies that perfectly match your profile, but that does not mean there is no room for someone who can improve RegLab.

- Book a demo

Boost risk management

Check adverse media, watchlists and run an automatic PEP check from RegLab.

An effective screening process

Manual screening is no longer necessary thanks to this feature! This add-on ensures that new files are automatically and fully checked for any PEPs, sanctions and/or adverse media. This way, you can be sure you don't forget to check a source.

This additional feature allows you to manage and streamline the entire screening process from a single platform. So separate subscriptions to external parties for adverse media, watchlists or PEP checks are no longer necessary. This makes the screening process easier and clearer!

You want your client file to be screened automatically, without consuming time and energy. RegLab helps you with this challenging task. Choose a fully AML-compliant screening process by adding this extension to the application.

This useful feature is available thanks to its integration with Comply Advantage. It collects data from various sources and constantly updates it with new information on high-risk individuals, entities and activities. So you are always up to date with the latest information!

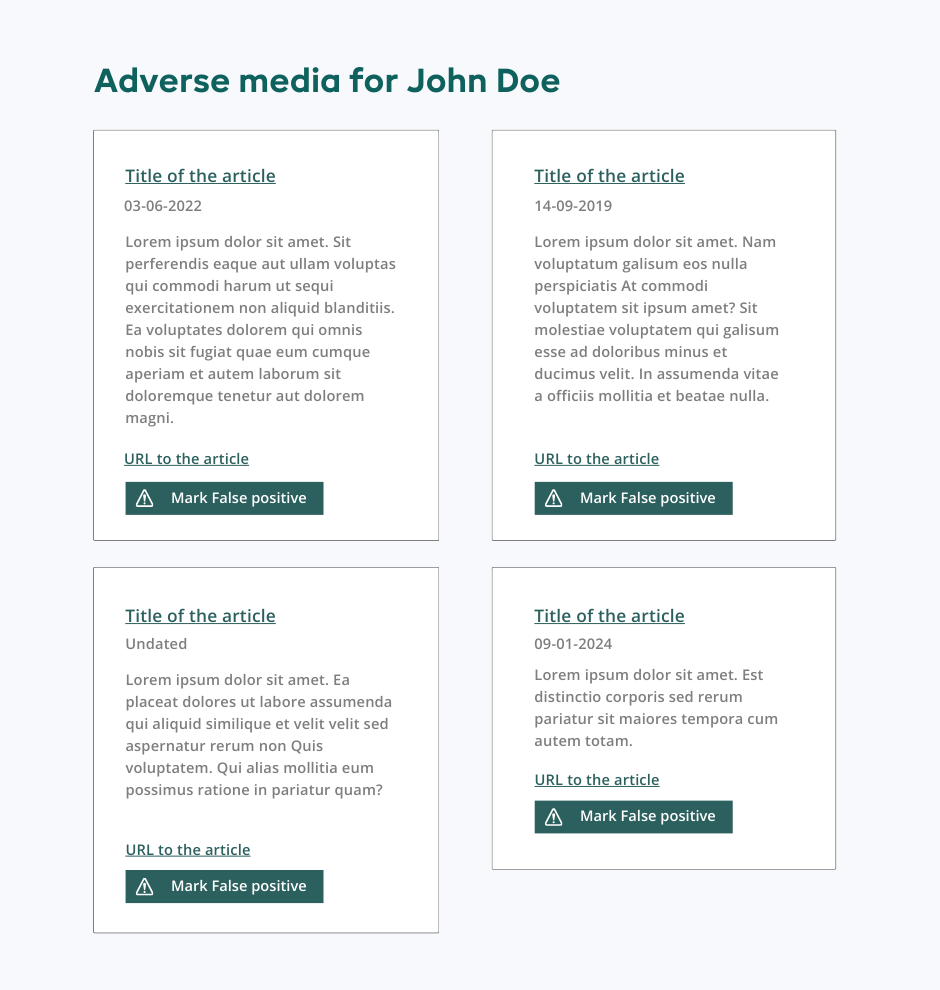

Adverse media check

When you add a person (representative, contact, UBO or PEP) or entity to the file, a thorough check is automatically performed to detect any negative publicity.

You get insight into the various articles relevant to the added person or entity, including the first lines, date of publication and source. Want to read more of the relevant article? You can! Just click on the link in the application to open the item.

In case an article contains no negative or relevant mentions, you can mark it as a 'false positive'. This way, you keep an overview of the adverse media.

Screen watchlists

An automatic check takes place to verify whether the client appears on any of the various watchlists. Both the lists of various government agencies and global lists are checked.

Individuals and entities on watchlists are usually considered high risk due to their involvement in criminal activities, links with terrorist organisations, money laundering or other prohibited practices. So it is very important to check these lists!

If the client appears on a list, you will be notified and can take appropriate action.

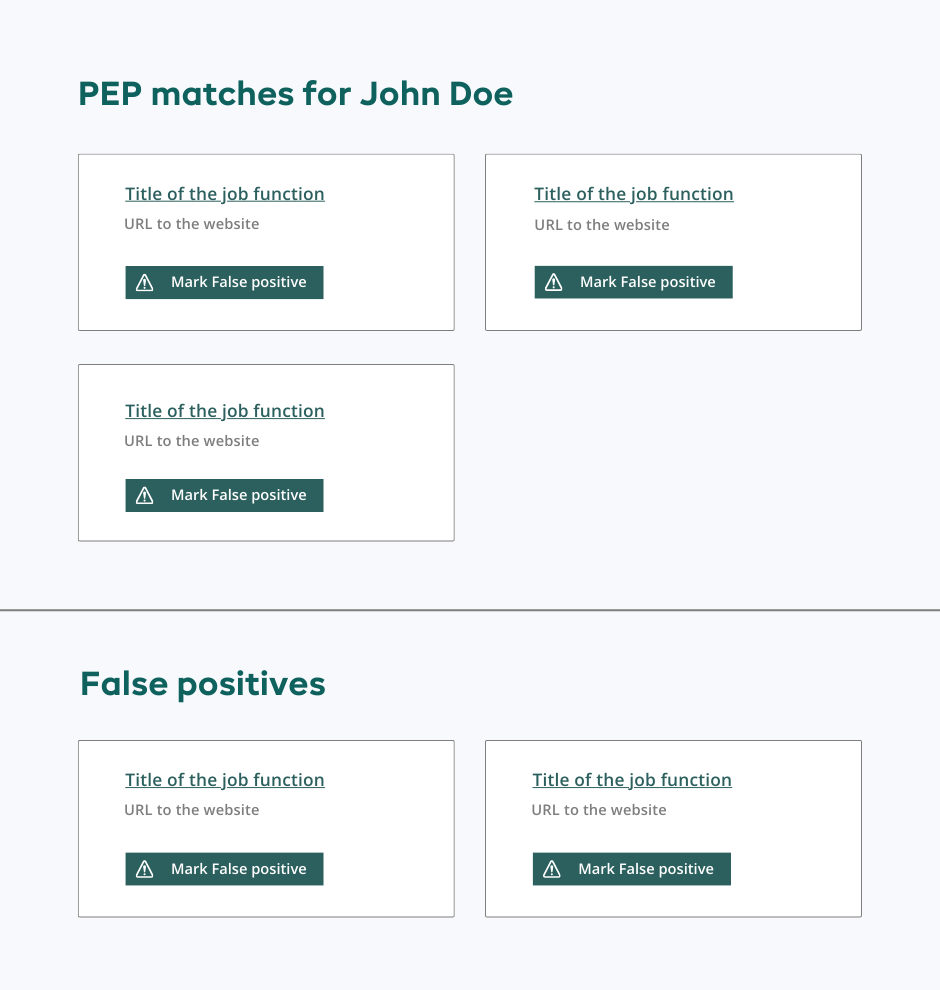

Conduct a PEP-check

PEP stands for Politically Exposed Person. Because of their influential position, they are often assumed to pose an increased risk of activities such as money laundering. It is therefore very important to know whether you are dealing with a PEP.

Be the first to know about important changes in the client's risk status thanks to our automatic PEP check.

This check is performed automatically when a person is added to the file. Does the person emerge as a PEP? Then you will receive an overview of his/her various job functions. Again, you have the option of indicating whether a result is a 'false positive'.

See for yourself how this feature works?

Sparked your interest?

Want to take your compliance process to the next level while increasing efficiency? Get in touch for options and costs.

Collaborating with other firms

Firms regularly forward work to each other. Big question in relation to AML is: if you receive an assignment through another firm, who is the actual client?